From reading this article, charter boat owners will learn about the different types of insurance, policy costs, and which types of insurance are best suited for the yacht charter business. Advice from topRik team lawyers, as always, is based on our own experience with our SimpleSail charter fleet, which is located in our marinas in Croatia and Montenegro.

We would like to warn you right away that this is too broad a topic, like any aspect of insurance legislation, since each individual insurance case has its own nuances. Our legal experts have tried to highlight the main provisions that can guide charter yacht owners when choosing the type of insurance. But before contacting an insurance company to draw up a contract, we still recommend that you first consult with independent lawyers in maritime law.

Overview of All Types of Yacht Insurance on the European Market

Today, the insurance business offers yachtsmen, including charter boat owners, a wide variety of insurance:

- Medical insurance for travel abroad - covers possible expenses associated with the provision of medical care while abroad, usually required by all countries for foreigners arriving on their territory, often has several levels of coverage.

- Disability insurance – covers the risk of becoming disabled during sailing, especially recommended for those who are going to take part in serious regattas, as well as all professional yachtsmen - athletes or boat haulers.

- Third party liability insurance. In the European market, this type of insurance (as applied to shipping) is divided into three main types: shipowner's liability insurance; captain (skipper) liability insurance; personal liability insurance.

- CASCO insurance. This type of insurance covers possible damage to the ship, its equipment and (in some cases) personal belongings on board in the event of damage or loss. It is important that the insurance fully covers all possible maritime risks (from grounding to pirate attacks) according to the principle “what is not expressly excluded is fully included”, which is not yet the norm in Europe.

- Insurance in case of cancellation of a subsequent charter due to damage to the yacht. This type of insurance is now becoming more and more popular. It protects the crew who chartered the vessel from unpleasant consequences in the event that the damage caused by the crew to the chartered vessel is so great that the yacht owner is forced to refuse to rent the boat to the subsequent crew.

- Deposit insurance.

- Insurance against accidents on board.

- Personal accident insurance. This type of insurance typically covers those health-related expenses that are not covered by regular health insurance.

- Insurance against unexpected interruption of charter sailing. This type of insurance policy covers expenses already incurred by crew members in the event that the skipper was unable to take part in the voyage and no replacement was found.

- Insurance against unexpected legal expenses. This is a relatively new and very broad area of insurance, which has special cases for shipowners.

- Life insurance. This type of insurance is usually concluded in favor of close relatives of the insured person in the event of his sudden death.

When concluding the above insurance contracts, you should make sure that the policy covers all insured events on the yacht during sailing.

The owner of a charter yacht, and especially a company, should know what types of insurance contracts a renter can enter into, so let’s briefly look at the main policies.

Charter Insurance. Three Main Policies

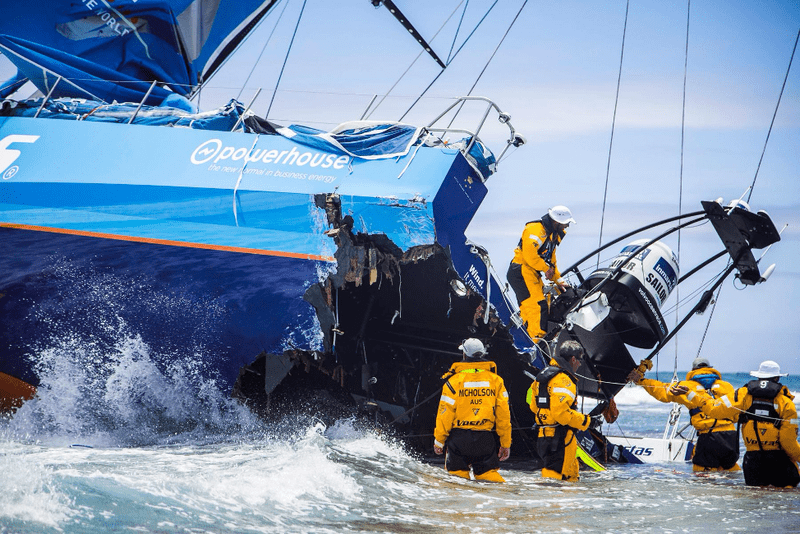

Squalls, storms, collisions, groundings - all these phenomena sometimes lead to unpleasant consequences in the form of damage to the chartered yacht. And then the question arises: who will pay for it?

Captain’s Liability Insurance to Third Parties

This form of insurance is the most important for a person chartering a yacht. The specifics of shipping are such that the captain (according to the Merchant Shipping Code) is responsible for almost everything that happens on board. The losses that may be caused in the event of his improper actions (or inaction) may be such that they can easily lead to personal bankruptcy, especially in the event of the loss of the ship, death or serious injury of a crew member. Of course, it is advisable to avoid such a development by insuring your liability.

Often, a charter company, along with a chartered yacht, offers an insurance contract that covers the yacht owner’s liability to third parties. And just as often, captains believe that this agreement fully applies to them as persons who have officially rented a yacht from the yacht owner, and fully protects them in all situations. However, the situation is actually not that simple.

Not in every country such contracts are mandatory (unlike the case with car insurance, for example): in Europe, shipowners' liability insurance is mandatory by law only in Spain, Italy and Croatia.

In a number of countries, such contracts, although mandatory, have an extremely low insurance amount required by law, and there is no uniform procedure even in a united Europe in this regard. If, for example, in Italy such an agreement necessarily covers the amount of damage equal to several million euros, then in Croatia this amount is a little more than one hundred thousand euros, which may be completely insufficient in case of serious damage.

Such agreements may have a lot of clauses (in addition to those already discussed) - for example, limiting the maximum permissible distance from the shore (or even the charter base) within which they operate, etc.

The third party liability insurance contract (as well as the CASCO contract) held by the charter company may contain the previously described clauses regarding the gross negligence of the skipper.

All packaged insurance contracts offered by charter companies are usually written in the language of the charter company's home country, which can make them difficult to read carefully.

In the event of severe damage to the yacht or death of a person, the skipper faces directly with the insurer, who is extremely interested in getting his money back through recourse.

These reasons alone are enough to understand: a captain who wants to go on a charter cruise with friends must independently purchase for himself a separate personal third-party liability insurance that covers as fully as possible all possible unpleasant cases. It is especially important in the case of charter sailing in remote “exotic” regions of the planet.

However, when concluding an agreement on personal liability insurance for a skipper, you must carefully study all its intricacies; first of all, you need to understand which cases are not covered by insurance.

Another difficult case is the situation when a pleasure yacht is rented for commercial purposes (overt or hidden), and the skipper who rented it receives some kind of remuneration for sailing. Typically, insurance companies exclude this possibility from the liability insurance contract for the captain of a charter yacht, providing for skippers for hire a separate contract with different, higher rates.

Deposit Insurance

The deposit insurance protects the crew of a chartered yacht from loss of deposit in the event of damage or loss of the vessel. It should be firmly remembered that the very fact of having such insurance in no way cancels the obligation of the yacht crew to make such a deposit (for example, using a credit card) before setting sail - these are different aspects of the issue.

Often crews of charter yachts do not understand that deposit insurance, firstly, does not cover all possible losses completely (the non-refundable part, that is, the deductible part, is also present here), and secondly, this insurance does not cover all possible causes of loss of the deposit.

Please remember: if during the investigation it is determined that the damage to the yacht was caused intentionally or due to gross negligence of the skipper (or his crew), the deposit insurance coverage will most likely not be paid.

So, is deposit insurance necessary for charter sailing? Compared to third party liability insurance for the skipper, it is not nearly as obligatory. Even in the worst-case scenario, the crew of the yacht will only lose the entire amount deposited, and it is by no means exorbitant. Therefore, this type of insurance pays for itself only in cases of very serious damage to the boat.

But insurance against loss of deposit makes a lot of sense if personal capabilities allow you to charter a yacht several times a year. In this case, on the one hand, the yachtsman may suffer quite significant monetary losses for the year; on the other hand, a number of insurance companies specializing in the yachting sector can offer more favorable annual (rather than one-time) insurance contracts.

Insurance for Unexpected Termination of Charter Sailing

This type of insurance is gaining popularity in Europe and the USA - they even insure their vacations in case of an unexpected end. It cannot be said that this type of insurance is in too great demand in everyday life.

Charter sailing is another matter. A company of six to eight people (sometimes more) gathers on board the yacht, and the success of the trip depends on the group as a whole, but especially on the captain himself. But what if he is suddenly forced to interrupt the voyage at the very beginning or cannot even fly out of the country for one reason or another? And who will reimburse the remaining members of the failed crew for their expenses?

Therefore, companies that have been working in the yacht insurance market for a long time turned to specialists with a request to calculate the likelihood of risks and the final cost of this type of service. The result is a product (now offered by many European insurance companies) that allows yachtsmen to not have to worry about losing money if a sailing trip is interrupted or canceled because the skipper is unable to participate.

As a rule, the cost of coverage includes the costs incurred by participants for round-trip air tickets, as well as the cost of chartering a yacht (in whole or in part). Typically, leading European insurance companies issue such insurance for relatively little money - from 4.5 to 5% of the cost of one-way air tickets, so such insurance seems quite profitable in the case of expensive non-refundable air tickets.

Owner’s Insurance. What to Look For

Insurance issues for owners of their own yachts are much more pressing than for yachtsmen renting a yacht from them. If the latter are responsible for the yacht for only one or two (rarely more) weeks a year, then the owner is obliged to worry about his vessel throughout its entire service life. And here too there are problems.

The shipowner has two main types of insurance: the already mentioned CASCO and third party liability insurance. Let's take a closer look at them.

CASCO Insurance

Insurance in case of damage or loss of a beloved yacht is, without exaggeration, a headache for any shipowner. On the one hand, he wants annual insurance payments to be minimal. On the other hand, it is desirable to have confidence that in the event of damage or loss of the vessel, the insurance amount paid will cover all possible losses and expenses as fully as possible. Therefore, you should take into account everything, even the smallest clauses and footnotes in the text of the insurance contract.

Sailing area. Very often, the insurance contract may stipulate the water area where the insured yacht should be located. As a rule, a short trip beyond its limits poses no threat to the owner of the ship, but if the contract clearly defines the water area of, say, the Mediterranean Sea, and the ship was damaged while ferrying it to the Caribbean, then you can hardly count on compensation for damage .

On-board equipment. It is important that the insurance contract contains the entire list of included onboard equipment necessary for full use of the vessel. But insurers almost never include removable and portable electronics (for example, a laptop) in this list, even if they are regularly used for navigation purposes.

The loss of the vessel. In the event of the loss of a yacht (especially in areas of shipping routes), the shipowner may face additional costs that may exceed the amount of the insurance payment. Such expenses, for example, may include fines for diesel fuel leaking from the tanks of a sunken yacht.

Gross negligence. Insurance companies behave much more strictly with regard to shipowners than with regard to amateur skippers: cases of damage or loss of a yacht due to gross negligence (of the owner himself or his hired captain) are almost never recognized as insurance. Exceptions to this rule are extremely rare and are not widely advertised.

Replacing old with new. Very often, disputes arise between shipowners and insurers about what to do if the cost of equipment or sailing parts supplied to replace failed units exceeds the cost of the old ones. For example, a new mast may turn out to be significantly more expensive than the old one.

Winter storage or repair. Statistics show the following: approximately half of all cases of serious damage or loss of yachts occur while the vessel is out of the water. It is necessary to make sure that the insurance contract takes this circumstance into account. Owners of trailer yachts should take care to clarify the areas covered by transport risk coverage.

Sailing wardrobe. Sail insurance is another concern for the shipowner. Their price is high and wear and tear is difficult to predict, so many insurance companies try to avoid covering them or impose very high deductibles. And damage to sails in strong winds is almost never an insured event - usually with winds of seven or eight force.

Discounts for trouble-free periods. As a rule, insurance companies provide very serious discounts for a long accident-free period - sometimes they can reach 30-40%. The other side of the coin is a noticeable increase in insurance premiums the year after the accident. Some companies, however, avoid this after the very first accident, if the client has been insured with them for several years.

Insurance cover. For a long time in Europe, there were separate clauses in insurance contracts regarding insurance against certain known marine risks. And only relatively recently, contracts were introduced into the practice of yacht insurance that cover damage from any marine risks, with the exception of only those that are specified separately.

Franchise. The non-covered part of the damage is the norm in CASCO agreements; only in the event of a complete loss of the vessel it may not exist. The owner, as a rule, has two options - a small deductible in combination with increased insurance premiums or a relatively large non-covered portion of the damage while keeping premiums low; the difference in their amount can be twofold.

Yacht Owner Third Party Liability Insurance

This type of insurance for shipowners seems no less important than CASCO. The damage that the owner of the vessel is capable of causing to the property, life or health of third parties, even with rare use of his yacht, can be very great.

Moreover, it is absolutely disproportionate to the average insurance premium charged by insurers to shipowners: usually its value in Europe ranges from 20 to 500 euros per year. Therefore, saving on this type of insurance seems completely unjustified. Although, as already mentioned, in European waters with the exception of Spain, Italy and Croatia, it is not required.

In general, the conditions for insurance of the shipowner's liability to third parties do not have any special pitfalls, but you should pay attention to two details.

A very important circumstance in a contract of this type of insurance is the presence in it of a clause on waiver of claims. The presence of such a clause in the insurance contract will mean that in the event of an accident (for example, a collision with another ship), in which the other party will be to blame, but does not have an insurance policy and/or funds to cover other people’s losses, the person insured under this contract (yacht owner) is guaranteed to receive compensation for damage already caused to him from his insurance company. Not every insurance company operating in the European yacht market today provides policyholders with such conditions.

It is also important to understand that the determining moment for the occurrence of an insured event under this type of insurance is the “state of guilt” of the insured person (ship owner). This means that when the shipowner is not at fault in the incident: say, if a yacht belonging to him caused damage to third parties under the influence of force majeure (for example, it was torn off properly moored by a storm), then the insured event should not occur. When concluding an insurance contract, you should pay attention to whether this circumstance is mentioned in the contract.

topRik experts once again remind you that the types of insurance contracts discussed in the charter business, the options and cases mentioned do not cover all the nuances of possible incidents at sea and on land. We advise you to enlist the services of an experienced lawyer in the field of maritime law, as well as a reputable insurance company if you want to truly protect your vessel and those on board.